Many people have heard of a FICA withholding from their paycheck, but not very many know what it means. The Federal Insurance Contributions Act (FICA) is a mandatory payroll tax paid by an employer and employee. The money is used to fund Social Security and Medicare, and it is taken from the pay of every working individual. Whether you work for a company or are self-employed, you pay FICA.

The Basics Of FICA

Your FICA deduction is only half of the money paid to the federal government for Social Security and Medicare. One half is paid by the employee, and then the employer pays the same amount the employee pays.

Starting Off The Calculations

The FICA amount paid in your name (half by you and half by your employer) is based on your gross pay for the pay period. This means that FICA is calculated based on how much money you make before any other deductions are taken out.

It is important to know that your pre-tax contributions to your retirement plan and your pre-tax savings for your medical spending are subject to FICA taxes but not income taxes.

Social Security Tax Rate

The first step in calculating FICA is to multiply the gross pay for the pay period by the Social Security tax rate. In 2017, that rate was 6.3 percent. There is a maximum amount of Social Security tax an employee can pay each year. Once the employee reaches that maximum, Social Security taxes are no longer deducted. However, the employer must still pay the Social Security tax based on the employee’s gross pay.

Medicare Tax

In 2017, the Medicare tax rate was 1.45 percent for employees that made under $200,000 per year. Employees who made more than $200,000 per year would pay an additional .9 percent Medicare tax. This additional tax is cumulative and does not take effect until the employee has made more than $200,000 for that year.

Add Them Together And Subtract

After calculating the two taxes based on the current rates, you subtract that amount from the employee’s gross pay and that is their FICA deduction. The employer must then make a separate payment to FICA based on the employee’s numbers.

Taking Out Too Much

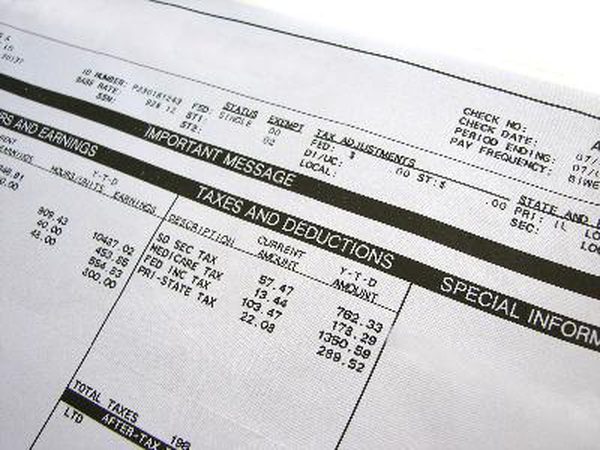

It is possible that an employer can take out too much in FICA deductions, which is a federal crime. To prevent issues with the IRS, the employer can refund the extra amount and the file IRS payroll tax correction form 941. The FICA deductions must show up on the employee’s regular pay stub and on their W-2 tax form at the end of the year.

Every American worker pays FICA, but not very many know what FICA is or how the deduction is calculated. It is always good to know where your money goes and how the government tries to get your pay before you do.